Hierarchical AI Multi-Agent Fundamental Investing: Evidence from China’s A‑Share Market

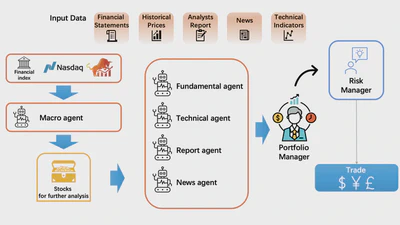

We present a multi-agent, AI-driven framework for fundamental investing that integrates macro indicators, industry-level and firm-specific information to construct optimized equity …