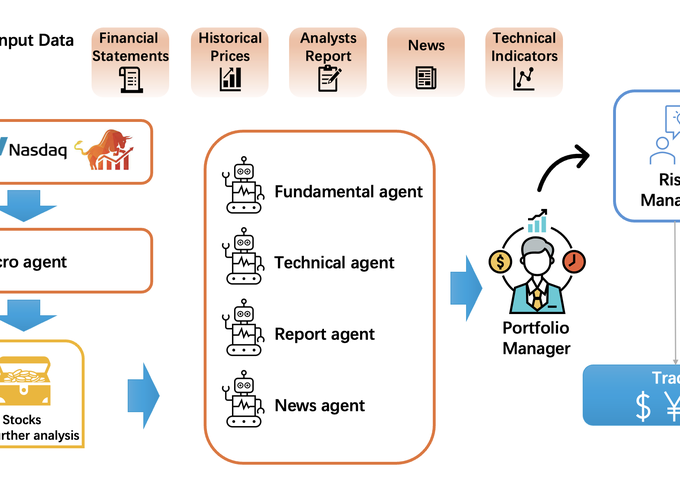

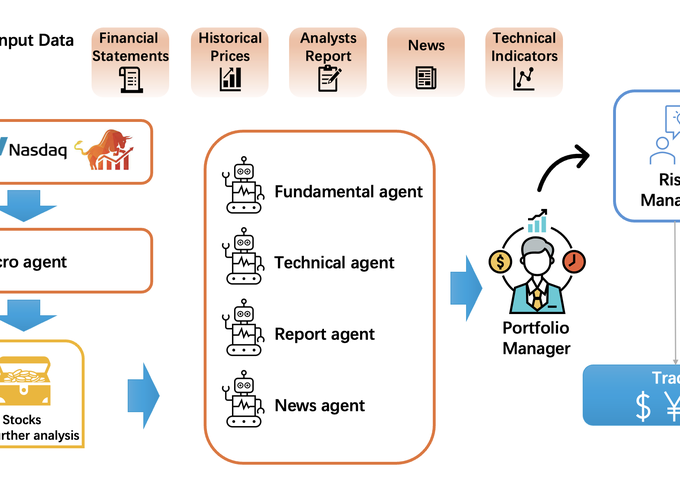

We present a multi-agent, AI-driven framework for fundamental investing that integrates macro indicators, industry-level and firm-specific information to construct optimized equity portfolios. The architecture comprises: (i) a Macro agent that dynamically screens and weights sectors based on evolving economic indicators and industry performance; (ii) four firm-level agents—Fundamental, Technical, Report, and News—that conduct in-depth analyses of individual firms to ensure both breadth and depth of coverage; (iii) a Portfolio agent that uses reinforcement learning to combine the agent outputs into a unified policy to generate the trading strategy; and (iv) a Risk Control agent that adjusts portfolio positions in response to market volatility. We evaluate the system on the constituents by the CSI 300 Index of China’s A-share market and find that it consistently outperforms standard benchmarks and a state-of-the-art multi-agent trading system on risk-adjusted returns and drawdown control. Our core contribution is a hierarchical multi-agent design that links top-down macro screening with bottom-up fundamental analysis, offering a robust and extensible approach to factor-based portfolio construction.