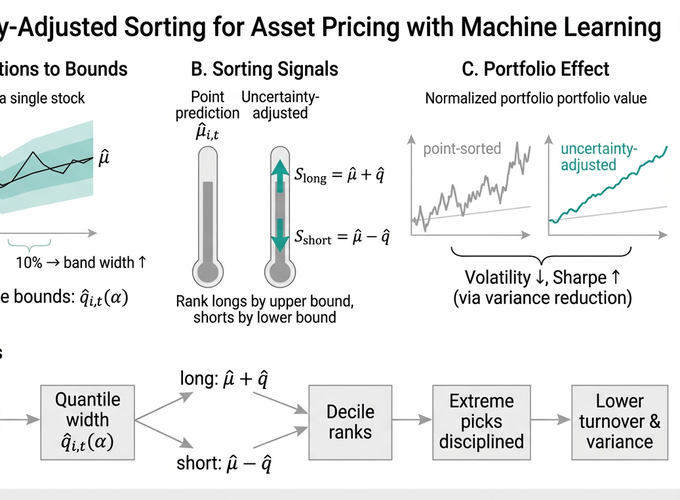

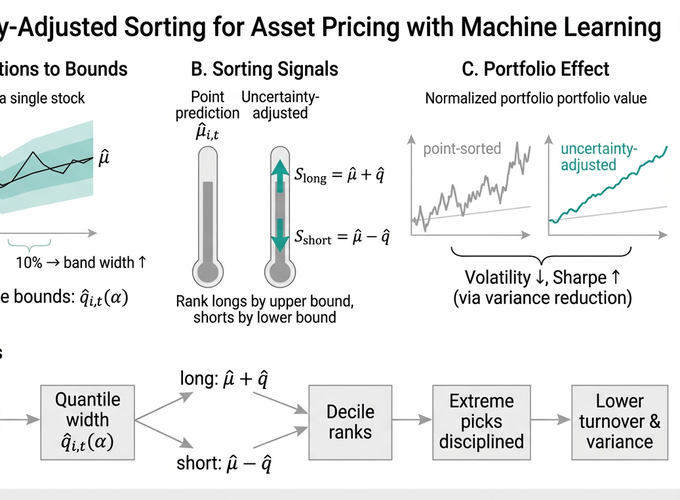

Machine learning is central to empirical asset pricing, but portfolio construction still relies on point predictions and largely ignores asset-specific estimation uncertainty. We propose a simple change: sort assets using uncertainty-adjusted prediction bounds instead of point predictions alone. Across a broad set of ML models and a U.S. equity panel, this approach improves portfolio performance relative to point-prediction sorting. These gains persist even when bounds are built from partial or misspecified uncertainty information. They arise mainly from reduced volatility and are strongest for flexible machine learning models. Identification and robustness exercises show that these improvements are driven by asset-level rather than time or aggregate predictive uncertainty.