Uncertainty-Adjusted Sorting for Asset Pricing with Machine Learning

Jan 1, 2026·

·

0 min read

·

0 min read

Yan Liu

Ye Luo

Zigan Wang

Xiaowei Zhang

Abstract

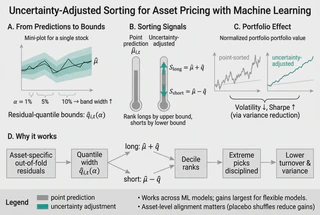

Machine learning is central to empirical asset pricing, but portfolio construction still relies on point predictions and largely ignores asset-specific estimation uncertainty. We propose a simple change: sort assets using uncertainty-adjusted prediction bounds instead of point predictions alone. Across a broad set of ML models and a U.S. equity panel, this approach improves portfolio performance relative to point-prediction sorting. These gains persist even when bounds are built from partial or misspecified uncertainty information. They arise mainly from reduced volatility and are strongest for flexible machine learning models. Identification and robustness exercises show that these improvements are driven by asset-level rather than time or aggregate predictive uncertainty.

Type

Authors

Chair Professor of Finance, School of Economics and Management and Shenshen Institute of Economics and Management, Tsinghua University.

Authors

Asociate Professor in Economics and Finance, Associate Director of the Institute of Digital Economy and Innovation at HKU Business School.

Authors

Associate Professor of Finance, School of Economics and Management and Shenshen Institute of Economics and Management, Tsinghua University.

Authors

I am an Associate Professor at HKUST, jointly appointed in the Department of Industrial Engineering and Decision Analytics and the Department of Economics, and the Academic Director of the MSc in FinTech program. I serve as an Associate Editor for several leading journals in the field, including Management Science, Operations Research, Navel Research Logistics, and Queueing Systems.